Mortgage lending is document-heavy by nature. Yet in 2025, many mortgage companies still rely on manual document processing that slows down approvals, introduces costly errors, and frustrates customers. According to Fannie Mae, 58% of lenders report inefficiencies in collecting and reviewing borrower documents as a top barrier to faster closings. According to ValuePenguin, it takes an average of 47 days to close a mortgage, and up to 60% of that time is consumed by document collection, review, and verification.

The growing pressure to reduce cycle times, maintain compliance, and improve borrower experience makes it clear that legacy systems no longer suffice. Mortgage document processing must evolve to handle high volumes of complex, unstructured paperwork with speed and intelligence. This blog explores how automation, particularly with AI Document Understanding, can eliminate bottlenecks and drive efficiency across the mortgage lifecycle.

Whether you’re a mortgage lender, underwriter, or operations lead, this guide is for you.

Mortgage document processing refers to the end-to-end handling of documents involved in the mortgage life cycle. This includes loan applications, income statements, credit reports, appraisals, disclosures, insurance forms, and closing documents.

Traditionally, these documents are reviewed, validated, and entered manually into loan origination or servicing systems. This not only slows down the process but also leaves room for errors and compliance risks.

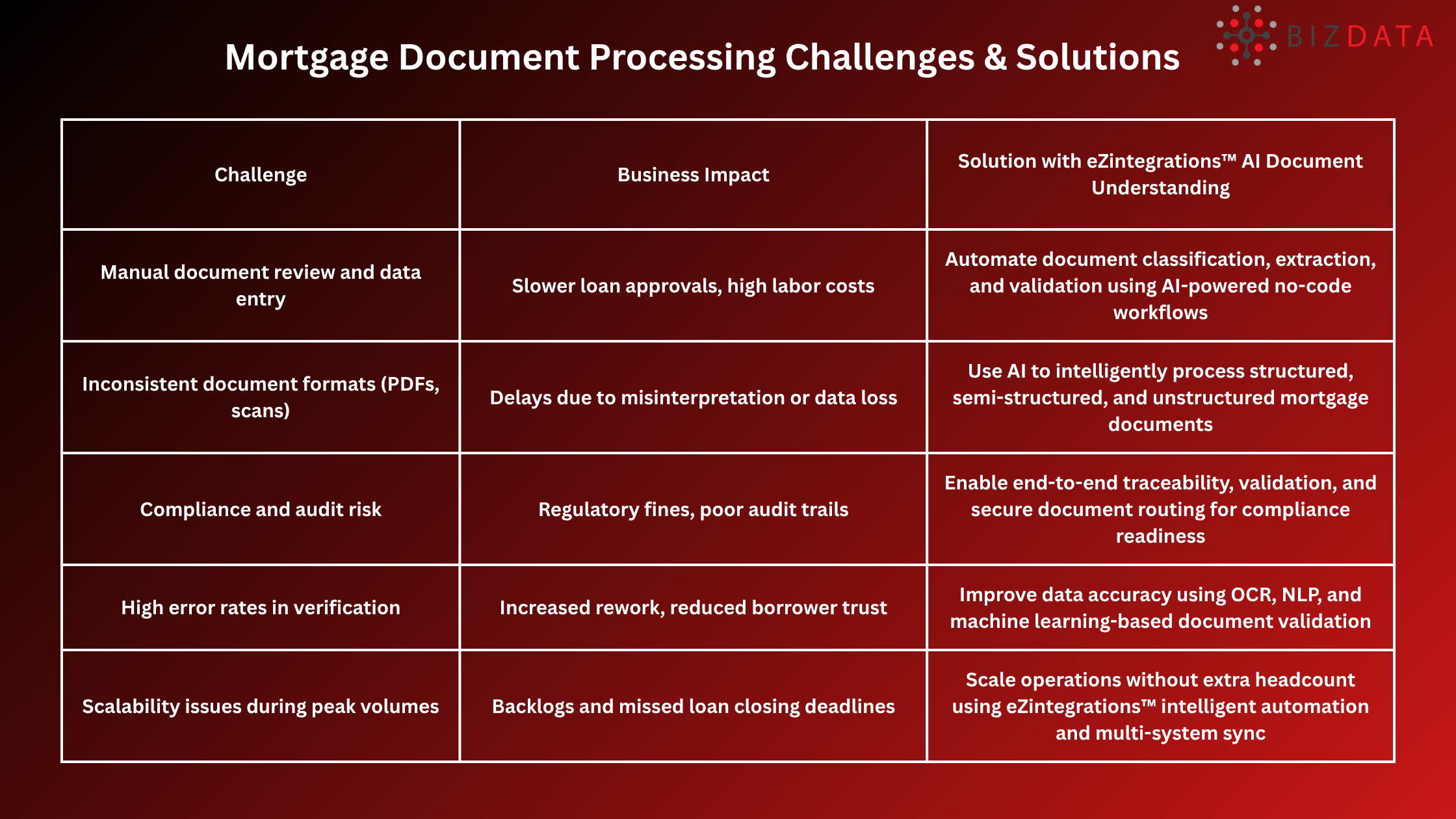

Manual mortgage processing methods are no longer sustainable in a digital-first lending environment. Lenders face mounting pressure to close loans faster while meeting regulatory demands.

Here are key pain points of traditional mortgage document processing:

Automation modernizes the mortgage document workflow by using AI and machine learning to understand, extract, and validate data from unstructured documents.

Here’s how automation benefits mortgage operations:

Nearly every document type in the mortgage lifecycle can be automated using AI Document Understanding.

Key documents include:

Automation ensures these documents are extracted, classified, validated, and routed to the right systems instantly.

Integrating eZintegrations™ AI Document Understanding into mortgage document processing is not just a technology upgrade. It is a strategic transformation that delivers measurable returns across your operations.

Here’s how AI-powered automation benefits mortgage lenders in 2025 and beyond:

With mortgage rates fluctuating, market competition rising, and borrower expectations evolving, speed and precision in document workflows are essential. eZintegrations™ AI Document Understanding helps lenders meet these challenges head-on with confidence.

If you’re ready to automate mortgage document processing, follow these steps:

Mortgage document processing doesn’t have to be slow, error-prone, or manual. With AI Document Understanding from eZintegrations™, lenders can automate core workflows, improve compliance, and close loans faster than ever before.

Don’t let manual processes hold your business back.

Try eZintegrations™ AI Document Understanding for free or book a free demo today to see how intelligent automation can transform your mortgage operations.

Q1. What is mortgage document automation?

It uses AI to extract and validate data from mortgage documents, removing the need for manual entry.

Q2. Is AI safe for handling sensitive borrower data?

Yes. Platforms like eZintegrations™ include encryption, audit trails, and compliance controls.

Q3. How long does it take to implement?

With no-code tools like eZintegrations™, implementation can begin in days, not months.

Q4. Can we still review documents manually if needed?

Yes. Human-in-the-loop options allow manual intervention during critical stages.

Q5. What if our documents are scanned or handwritten?

eZintegrations™ uses OCR and computer vision to process scanned or handwritten content with high accuracy.

Q6. What is Mortgage Document Processing?

Mortgage document processing refers to the end-to-end handling of documents involved in the mortgage life cycle.

Q7. How to Automate Mortgage Document Processing?

Through eZintegrations™ AI Document Understanding, we can automate Mortgage Document Processing.

Q8. Which is the best Mortgage Document Processing tool?

eZintegrations™ AI Document Understanding is one of the best Mortgage Document Processing tools.