Year-end tax filings can be a nightmare. From handling hundreds or thousands of tax forms to chasing signatures and verifying data, it’s a time-consuming and error-prone process. Many businesses still rely on manual tax form handling, leading to delays, incorrect submissions, and even penalties.

Manual tax form processing eats up valuable time and creates compliance risks. The process involves collecting data from multiple systems, standardizing formats, verifying compliance, and generating forms for filing. For accounting teams already stretched thin in Q4, it can become overwhelming.

That’s where automation comes in. With AI-powered tax form processing tools, companies can accelerate workflows, reduce mistakes, and ensure every deadline is met with confidence.

This blog is for finance heads, compliance managers, and operations teams in US-based companies who want to eliminate the year-end tax chaos and bring efficiency to their document workflows.

Tax form processing refers to the collection, validation, generation, and filing of tax-related forms such as W-2, 1099, 1098, and others. It involves pulling information from payroll, contractor payments, benefits, and other data sources to meet state and federal reporting requirements.

It’s essential for:

Handling tax forms like W-2s, 1099s, or GST invoices manually is time-consuming and error-prone. Compliance deadlines leave no room for mistakes, and delays can lead to penalties or reporting issues. Automating this process with AI not only ensures accuracy and speed but also frees up finance teams from repetitive tasks.

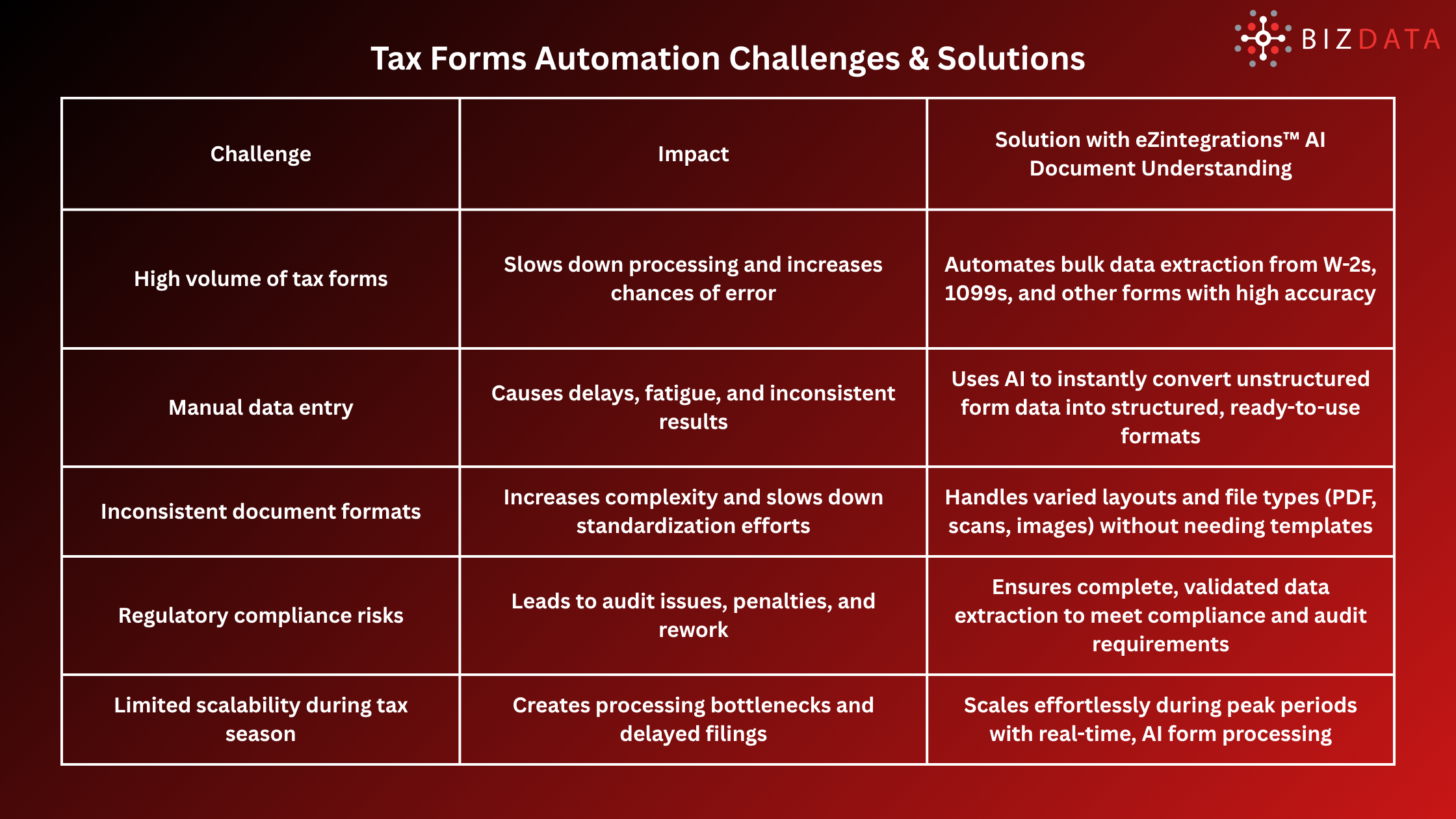

Enterprises face real-world hurdles when managing large volumes of tax documents across departments, geographies, and systems. These challenges aren’t just about inefficiency, they directly impact financial health, reporting accuracy, and operational workflows.

eZintegrations™ AI Document Understanding uses advanced AI technologies to extract, structure, and validate tax data at scale. It identifies form types, extracts fields like Tax IDs, amounts, names, and deadlines, and integrates the data directly with your ERP or tax platform.

Our platform is built to handle a wide range of regional and global tax forms, across industries like finance, insurance, logistics, and payroll processing. These include scanned, digital-native, and PDF formats.

Automating tax form processing isn’t just about speed. It’s about creating a system of trust, visibility, and compliance. Here’s what businesses gain:

eZintegrations™ AI Document Understanding platform is designed to automate tax document processing from start to finish. Here’s how it works:

You don’t need to overhaul your entire finance stack to get started. With just a few sample forms, eZintegrations™ AI Document Understanding can show results in days.

Year-end doesn’t have to mean chaos. Automating tax form processing helps teams focus on strategy, not paperwork. Whether you’re a CFO, controller, or finance lead, smart automation gives you accuracy, compliance, and speed without burning out your team.

If your enterprise handles high volumes of tax forms, it’s time to make AI your advantage with eZintegrations™.

Try eZintegrations™ AI Document Understanding free or book a live demo today to see how it transforms your tax form processing.

Q: Can AI automate tax form processing?

Yes, AI can extract and structure data from tax forms like W-2s, 1099s, and more.

Q: What’s the best way to digitize tax documents?

Use an AI-based solution like eZintegrations™ AI Document Understanding processes PDFs, scans, and images with high accuracy.

Q: Is OCR enough for automating tax forms?

No, OCR often misses context or handwriting. AI-based tools are more accurate and reliable.

Q: How do businesses reduce manual tax form entry?

By using document understanding platforms that automate data capture and export.

Q: Can AI handle handwritten tax forms?

Advanced AI platforms can process handwriting, especially when OCR and NLP struggle.