Why Insurance Policy Parsing Automation Matters?

What if your underwriting teams could eliminate hours of data entry per policy? Every day in the U.S., insurers waste time manually parsing policies from PDFs, emails, or scans—slowing down policy issuance and risking data mistakes.

According to a Medicaid study, 15‑30% of administrative expenses stem from manual tasks like data entry and rework (easysend.io)

Insurance Policy parsing is crucial, it powers coverage validation, premium setup, compliance checks and clear customer communication. But done manually, it eats time and invites errors. This blog is for policy operation leads, claims teams, and compliance officers looking to automate parsing workflows and build data reliability.

Insurance Policy parsing refers to extracting key information like policyholder name, coverage limits, effective/expiry dates, premiums, endorsements, exclusions from unstructured documents into structured, actionable formats.

Typically, this is done manually, leading to errors and process lag. With automation, every clause and figure become system-ready, no manual entry is needed.

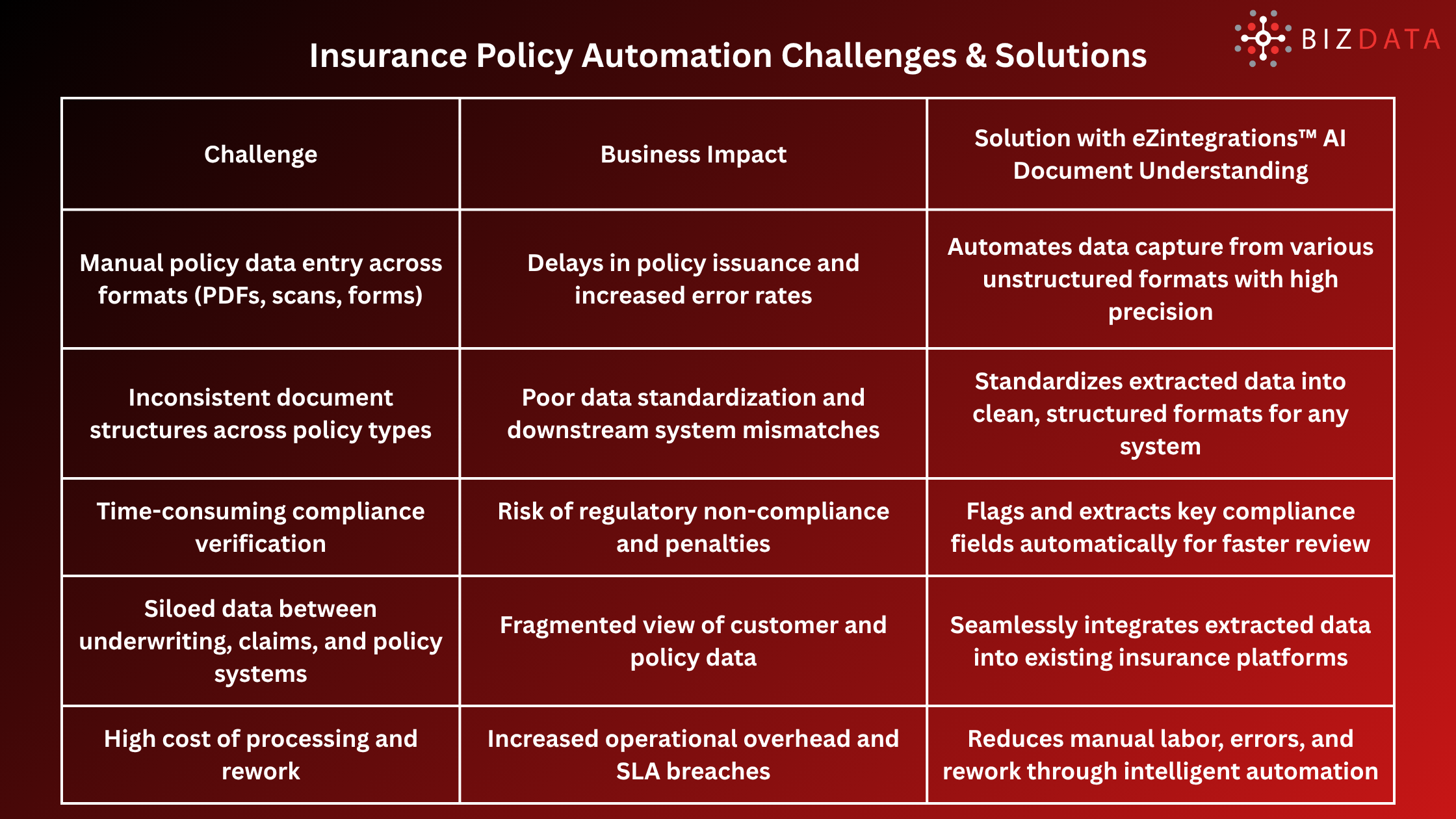

Manual parsing workflows can lead to a range of issues:

These risks compound as volumes rise or more digital distribution channels emerge.

Implementing policy parsing automation starts with choosing the right approach and technology:

Before diving into bullet points, this section outlines what automation platforms achieve. They ingest any document format PDFs, emails, scans then use AI to parse policy content, map data elements to your systems, and flag ambiguities or deviations. Now let’s look at what exactly automation platforms do:

Automating parsing brings measurable and qualitative value:

Automation helps:

Here’s why eZintegrations™ AI Document Understanding stands out:

This platform makes sure your policy data is accurate, auditable, and ready for action—without manual entry.

While we respect client confidentiality, automation users have reported:

Those gains come with real ROI, not guesswork.

Automation adoption isn’t always plug-and-play. Watch out for:

Implementing with eZintegrations™ AI Document Understanding helps zero-template parsing and built-in support smooth onboarding and training.

Start small, scale fast:

The ROI becomes visible before you fully roll out.

Insurance Policy parsing shouldn’t be a manual burden. It’s a core part of delivery and compliance. Automation is not a promise, it’s a modern necessity for speed, accuracy, and scalability.

With eZintegrations™ AI Document Understanding, policy processing becomes fluid, error-free, and traceable. It frees teams to focus on value, not document entry.

Want to reduce errors and accelerate issuance?

Try eZintegrations™ AI Document Understanding for Free or Book a Free Demo Today!

What is insurance policy parsing?

It’s extracting structured policy data from documents like PDFs, endorsements, images into system-ready fields.

How accurate is automated parsing compared to manual?

Automation typically delivers 90 %+ accuracy, depending on document quality, and eliminates human fatigue.

Can eZintegrations™ handle custom policy formats?

Yes. It uses zero templates and learns clause patterns, so it adapts to new formats and layouts.

Is the parsed data audit-compliant?

Absolutely. Every extraction is logged, time-stamped, and version-tracked for audit and regulatory use.

How long does implementation take?

Small pilots can run in days. Full deployment may take weeks depending on integration complexity.