Every day, U.S. lenders wrestle with mountains of documents income statements, IDs, credit reports, bank statements all slowing down approvals.

A OneSpan case study shows that automating document handling helped a major U.S. bank cut 80% of loan document processing costs, freeing up 95,000 staff hours annually for value-added tasks. That’s not just savings, it’s transformed capacity.

This blog is crafted for loan operations leaders, underwriters, and fintech strategists focused on speeding approvals, cutting errors, and giving borrowers a smoother, faster experience.

Loan Application Document Review is the process of collecting, validating, and processing all documents required to assess a borrower’s eligibility, like proof of income, identity, credit history, and collateral.

Automating this review lets you extract relevant data, validate completeness, and flag errors instantly. Instead of manual checks, your team works with structured, reliable data from day one.

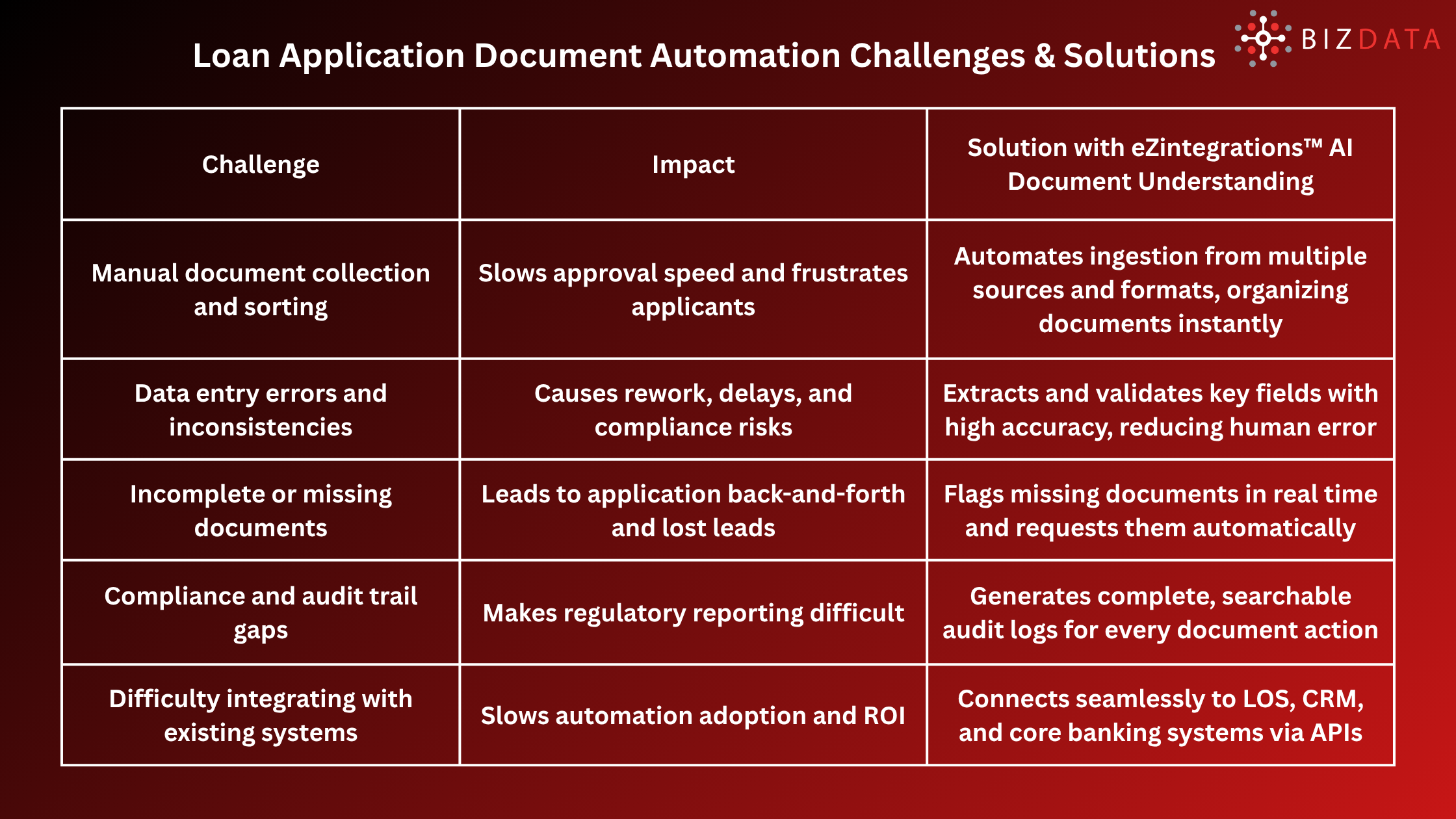

Here’s why the old way doesn’t work in today’s fast-paced lending world:

The result? A broken approval process that costs time, money, and trust.

Automation turns document chaos into clarity. Here’s how an automated system like eZintegrations™ AI Document Understanding tackles the process:

Before diving into bullet points, it’s worth noting that automation platforms streamline ingestion, extraction, validation, and integration across varied formats like PDFs, scans, email attachments, digital forms. Now, let’s see how they do it:

Automation is more than convenience; it’s measurable impact:

Even good tools need thoughtful setup. Watch for these pitfalls:

eZintegrations™ AI Document Understanding outpaces traditional systems:

It’s not just automation; it’s automation that understands.

Let’s put numbers to it. Many institutions leveraging automated document workflows report:

These gains translate into stronger margins, happier customers, and strategic agility.

Here’s a simple rollout plan:

Start lean, learn fast, scale smart.

Loan application processing shouldn’t be stuck in slow, error-heavy manual loops. Automating document review is not just a tech upgrade, it’s a business upgrade. With eZintegrations™ AI Document Understanding, you turn document workflows into decision-ready data.

Want faster approvals, fewer errors, and stronger compliance?

Try eZintegrations™ AI Document Understanding for Free or Book a free demo today!

What types of loan documents formats can be automated?

eZintegrations™ AI Document Understanding support any format like scanned PDFs, emails, digital forms. The system extracts data across layouts without needing templates.

How accurate is automated document review?

Accuracy typically exceeds 90%, depending on document quality

Is automation audit-friendly?

Yes, every extraction, flag, and action are time-stamped and versioned, simplifying audits.

How long does it take to implement?

A pilot can be up and running within days. Full deployment might take weeks depending on integration.

Does it work with legacy systems?

Yes, eZintegrations™ offers connectors and flexible APIs to integrate with both modern and legacy LOS or CRM tools.