Financial institutions are under intense pressure to handle growing data volumes while staying compliant, secure, and customer focused. Yet, many still struggle with disconnected systems, slow manual workflows, and compliance headaches. These inefficiencies cost time and money, but they also create risk.

That is why AI Data Integration for Finance is becoming non-negotiable in 2025. According to McKinsey, banks that effectively use AI can boost revenues by 34% source: McKinsey. On the other hand, poor data integration leaves firms exposed to reporting errors, fraud vulnerabilities, and lost growth opportunities.

This guide is written for CIOs, CTOs, compliance heads, and financial data leaders who want to understand the role of AI-powered integration in modern finance. You will learn the benefits, challenges, real-world applications, and why platforms like eZintegrations™ are shaping the future of financial data automation.

AI Data Integration for Finance refers to using artificial intelligence to connect, transform, and manage data across multiple financial systems. Unlike traditional ETL tools, AI-driven integration adapts to different data formats, detects anomalies, and automates workflows in real time.

In simple terms, it is about breaking down data silos in banks, insurance firms, and financial institutions to create a single, reliable source of truth for decision-making and compliance.

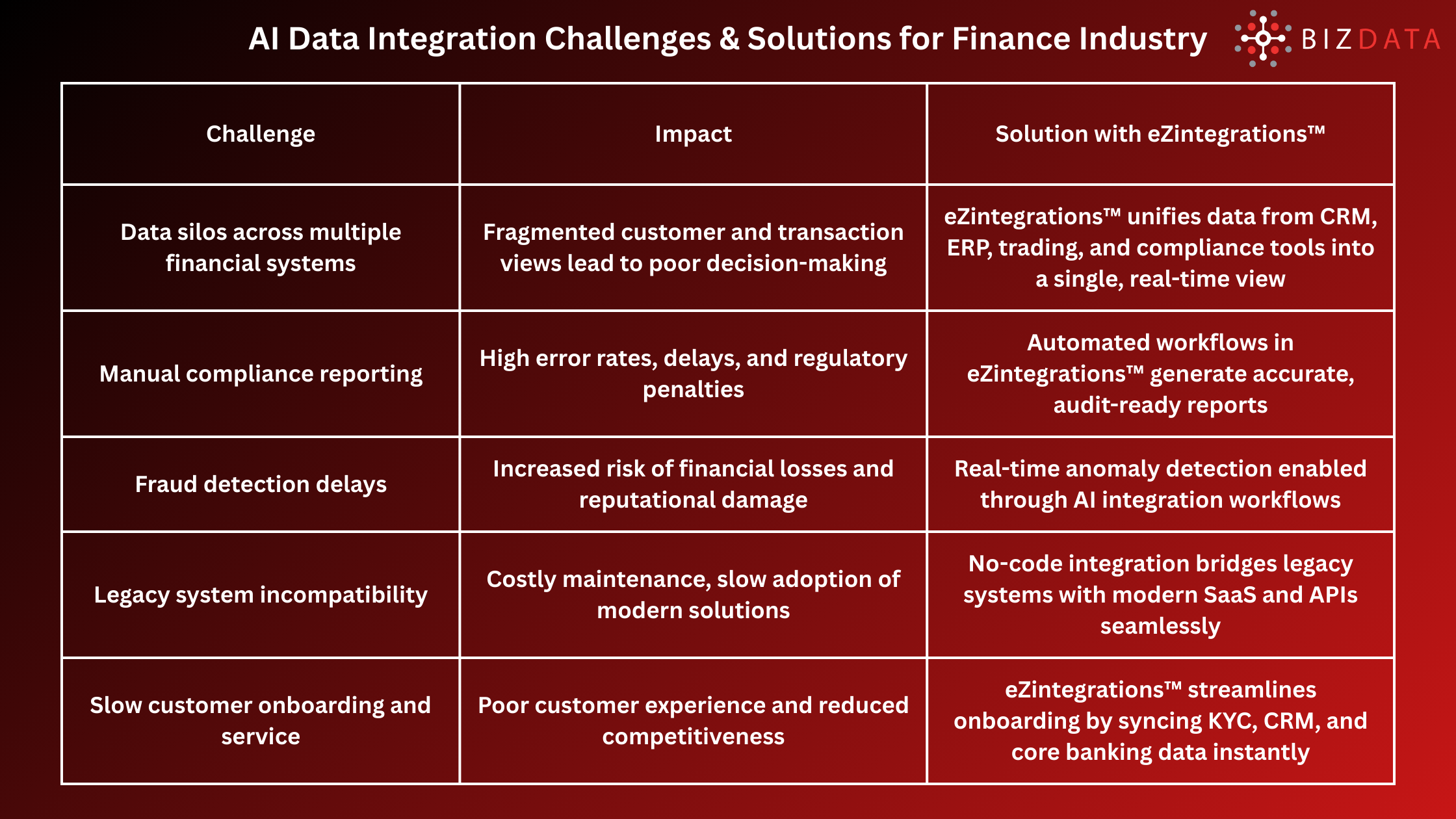

The finance sector is more data-intensive than ever. Yet outdated processes often hold firms back. Here are some of the biggest challenges institutions face today:

AI integration platforms solve these pain points by automating workflows, enabling real-time data flow, and ensuring security at scale.

Financial institutions that adopt AI-powered integration solutions are seeing measurable improvements. Here is how it impacts business outcomes:

AI-driven data integration is not just a buzzword. Financial institutions are applying it in multiple ways:

Automating compliance reports with AI reduces errors and cuts preparation time.

AI-powered integrations analyze data from multiple transaction points to flag anomalies in real time.

Banks can unify customer data across CRM, core banking, and support platforms for personalized offerings.

Integrated AI workflows help credit teams analyze both structured and unstructured data for better lending decisions.

During mergers, AI data integration ensures smooth consolidation of financial systems and customer records.

eZintegrations™ is a no-code, AI-driven data integration and workflow automation platform that addresses the unique challenges of the finance industry.

Here’s how it supports banks, insurers, and investment firms:

Example: A multinational bank used eZintegrations™ to unify customer onboarding data across CRM and KYC systems. This cut onboarding time by 40% and reduced compliance risks.

When properly implemented, AI-driven integration creates lasting advantages:

By 2025, AI-powered integration will be standard for financial firms. We can expect growth in these areas:

The finance industry in 2025 cannot afford outdated and siloed data systems. AI Data Integration for Finance is essential for compliance, risk management, and growth.

Platforms like eZintegrations™ make this transformation possible with no-code, real-time, and secure solutions built for enterprise scale.

Ready to see how eZintegrations™ can power your financial workflows? Book a Free Demo Today

Recommended Blogs:

7 Data Workflow Automation Mistakes Enterprises Must Avoid in 2025

AI Agent Workflow Automation with eZintegrations™ and Weaviate

AI Data Integration for Insurance Industry Guide 2025

How Agentic AI Will Transform Enterprise Systems Beyond 2025

Q1. What is AI Data Integration for Finance?

It is the use of AI-driven platforms to connect, transform, and automate data across multiple financial systems for accuracy, compliance, and efficiency.

Q2. How does AI integration help with compliance?

It creates automated audit trails, improves reporting accuracy, and ensures real-time monitoring for regulations like Basel III and GDPR.

Q3. Can eZintegrations™ integrate legacy banking systems?

Yes, it connects both modern SaaS applications and legacy on-prem systems without coding.

Q4. What are the top use cases for finance?

Fraud detection, regulatory reporting, credit scoring, customer 360 views, and M&A data consolidation.

Q5. Is AI integration secure?

Yes, enterprise-grade encryption and access controls make AI-powered integrations secure for sensitive financial data.