Every second lost to manual processing costs an insurer for both time and reputational risk. The need for smarter automation is more urgent than ever. For example, one research resource notes that insurers implementing workflow automation report an average 65% reduction in operational costs by automating onboarding, policy-management and claims workflows. Meanwhile, the global Insurtech market is forecasted to grow at a 36% CAGR between 2025 and 2034, highlighting the scale of opportunity. ( GlobeNewswire)

If you work in U.S. insurance – whether at a carrier, MGA, broker-dealer or Insurtech firm – this guide on AI workflow automation for insurance is written specifically for you. You’ll get a clear view of what it is, why it’s critical in 2025, how to apply it, the challenges to overcome and how to make it real using platforms such as eZintegrations™.

In the context of the U.S. insurance industry, AI workflow automation refers to the use of artificial intelligence, machine learning, natural language processing, robotic/agentic automation and orchestration to automate repetitive or decision-intensive tasks across the insurance value chain.

Specifically for insurers this might include:

In essence, AI workflow automation goes beyond “manual tasks replaced with bots”. It means embedding AI in the process of orchestration, so decisions, routing and integrations become intelligent and real-time.

Insurers are facing rising operational costs, regulatory burdens, and higher customer expectations. According to a report by Deloitte, the non-life sector in the U.S. is expected to improve profitability in 2024-25 and digital transformation is central to that. Workflow automation directly addresses the cost base by reducing manual effort, errors, and delays.

The Insurtech market growth (36% CAGR through 2034) signals that insurers and their partners are embracing digital innovation at scale. GlobeNewswire Also, AI in insurance workflows (claims, underwriting, risk) is forecasted to grow markedly. Market Research Future

Policyholders expect faster service, personalized experience, and transparent claims handling. At the same time, regulatory scrutiny (data, AI-bias, automation in decision-making) is intensifying. Automation platforms must therefore be intelligent, auditable, and compliant.

Many U.S. insurers are still using siloed systems, fragmented workflows and manual documents. Automation offers a chance to modernize while integrating legacy systems via APIs and workflow orchestration.

Carriers and brokers that succeed in automating processes intelligently will gain advantages in speed, cost, customer satisfaction, and data-driven decision-making. This can become a competitive moat in 2025.

Here’s a phased approach to applying automation intelligently:

Start by identifying the processes that:

Potential use cases include:

Key architectural considerations:

Platforms such as eZintegrations™ fit this model: they offer AI Document Understanding (extracting data from PDFs, images, docs) and workflow automation bridges with no-code configuration.

For a selected use case, you’ll need to:

Track business metrics such as:

Refine the workflow: handle exceptions, improve AI model accuracy, expand to adjacent processes. Then scale across departments or regions.

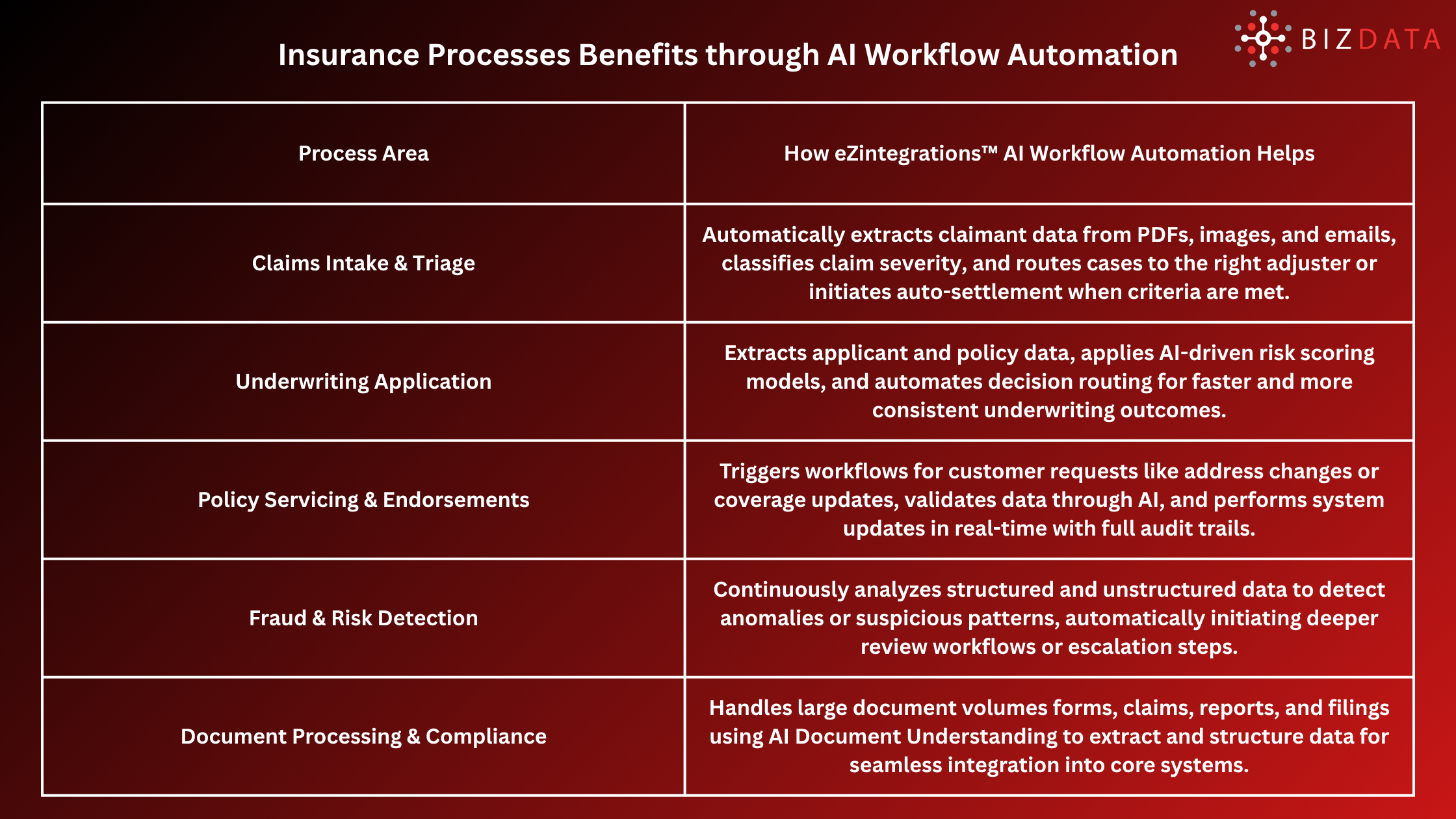

Here’s a table of insurance workflow areas and how AI workflow automation can transform them:

For example, research suggests that AI-powered claims processing is set to expand significantly: the market for AI in insurance claims processing is estimated at USD 172.65 M in the U.S. in 2024 and expected to grow at ~17.7% CAGR between 2025-2034. (Source: Market.us Scoop)

When considering a platform, eZintegrations™ stands out in a few ways for U.S. insurers:

By building AI workflows using eZintegrations™, insurers can move from isolated automation tools to full workflow orchestration where document intake, AI decisioning, system integration and human review are all part of one managed flow.

This is exactly the kind of intelligent automation that research calls “agentic automation” for insurance.

Many insurers struggle with fragmented data, legacy systems, and inconsistent document formats. Poor data quality undermines AI accuracy.

How to manage: Start with a data audit, clean up key data sources, ensure your workflow automation platform can ingest from varied sources and connect via APIs.

Bridging legacy policy systems, billing engines, CRM, and document repositories can be messy.

How to manage: Use a platform with broad connector support and a no-code bridge layer (such as eZintegrations™). Priorities use cases where integrations are bound.

Automating workflows involve process redesign, human role changes, and risk of resistance. Also, regulatory compliance (AI-bias, auditability) is a concern.

How to manage: Engage business stakeholders early, define roles clearly, build feedback loops, and provide training. Set governance frameworks for AI decision review, audit logs, and exception handling.

If you don’t define metrics up-front, automation efforts can stall.

How to manage: Define clear KPIs (time savings, cost reduction, error reduction, customer satisfaction) and monitor them. Start with pilot use case, then expand based on results.

AI models may degrade over time, or vendor dependencies may limit flexibility.

How to manage: Choose platforms that allow model retraining or integration with business-specific logic. Ensure exportability and versioning of workflows.

A mid-sized U.S. property & casualty insurer had a major pain point: claims intake involved manually reviewing scanned images, extracting claimant and policy data, routing to adjusters, and entering data into the claims management system. Turnaround time: several days; high error rate; rising customer complaints.

Solution: They implemented an AI workflow automation platform. Key changes:

Results: Time to triage reduced by ~70%; manual errors dropped significantly; customer satisfaction improved; cost per claim decreased.

This type of streamlined AI-enabled workflow represents the target state of “AI workflow automation for insurance”.

From Automation to Intelligence: The Insurance Evolution of 2025

In 2025, the insurers who succeed won’t just adopt automation; they’ll orchestrate intelligent workflows that combine AI, data integration, and process automation. By embracing AI workflow automation for insurance, carriers and brokers in the U.S. can reduce costs, speed operations, stay compliant and deliver superior customer experience.

Platforms like eZintegrations™ give you the building blocks: no-code AI document understanding, workflow automation, connectors and real-time integrations. If you’re ready to move beyond pilots and scale automation across underwriting, claims, servicing and compliance, book a free demo of eZintegrations™ and start creating insurance workflows that deliver outcomes.

Recommend Blogs:

Q1: What exactly does “AI workflow automation for insurance” include?

A1: It covers the use of AI (machine learning, NLP, computer vision) plus workflow orchestration (triggers, routing, decision logic, integrations) to automate or assist insurance processes claims, underwriting, servicing, compliance.

Q2: How soon can an insurer expect to see benefits?

A2: With a focused pilot on a well-defined process (for instance, claims triage), benefits (time reduction, cost savings) can appear within months. The key is selecting the right use case and monitoring metrics.

Q3: Are there regulatory risks when automating insurance workflows?

A3: Yes. U.S. insurers must consider data privacy (HIPAA for health, state insurance regulatory rules), auditability of decisions, and avoiding bias in AI models. Platforms should support traceability, human-in-loop, and governance.

Q4: How does document automation fit into this strategy?

A4: Many insurance workflows start with documents (claims forms, policy applications, endorsements). AI Document Understanding – extracting structured data from unstructured documents – is often the trigger for downstream workflows. For example, eZintegrations™ supports this and integrates the output into real-time workflows.

Q5: Can legacy insurers adopt these workflows without replacing everything?

A5: Yes. The modern approach is to overlay automation on existing systems via APIs and orchestration platforms rather than rip-out everything. No-code tools help business users connect, automate, and scale without full technology overhaul.