The insurance industry runs on data. Every policy, claim, risk assessment, and compliance report depends on accurate and timely information. Yet most insurers still struggle with siloed systems, legacy platforms, and manual workflows. According to McKinsey, automation and AI in insurance could generate up to $1.1 trillion annually in value across the industry by 2030 (source).

This is where AI Data Integration for Insurance becomes critical. By using AI-driven platforms, insurers can connect disparate systems, automate repetitive tasks, and gain real-time insights for faster decision-making. For CIOs, data officers, and claims managers, the pressure is mounting. Customers expect seamless digital experiences, regulators demand transparency, and competitors are already leveraging AI for growth.

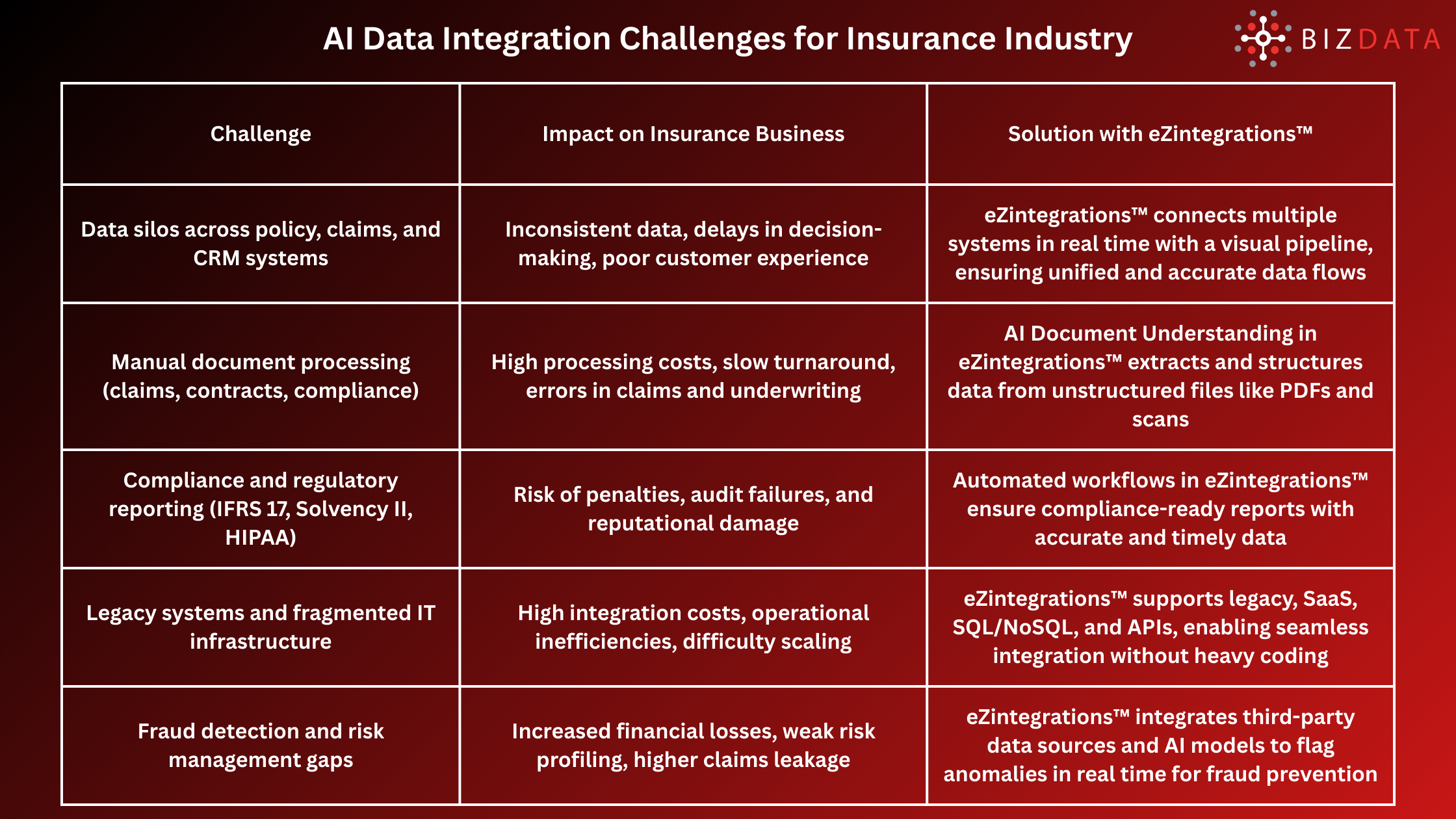

The rest of this guide explores how AI data integration is reshaping insurance, the specific challenges it solves, and how solutions like eZintegrations™ are helping insurers build scalable, future-ready workflows.

Insurance data comes from multiple sources: policy admin systems, CRMs, claims databases, third-party APIs, and regulatory portals. Without AI-enabled integration, insurers face critical issues:

Addressing these challenges requires intelligent automation that not only connects systems but also understands and structures data.

AI Data Integration for Insurance is the use of artificial intelligence to unify data across systems, extract insights from unstructured sources, and automate complex workflows. Unlike traditional middleware, AI integration platforms bring cognitive abilities into the data pipeline.

Key features typically include:

This approach transforms integration from a backend IT problem into a strategic driver of growth.

The benefits go beyond cost savings. AI Data Integration empowers insurers to compete in a digital-first economy.

A Deloitte survey shows that 74% of insurers consider AI a priority investment for improving operational efficiency and customer experience.

AI-driven integration is not just theory. Here are practical ways insurers are applying it:

AI platforms extract and validate claims data from PDFs, scanned forms, and customer emails, then sync it to claims systems automatically.

By integrating customer, claims, and third-party data, AI models can flag anomalies in real-time to prevent fraud.

AI data workflows bring together internal and external data sources (e.g., credit, health, IoT devices) for faster and more accurate risk profiling.

Unified data enables faster onboarding, instant policy updates, and self-service portals.

Structured data pipelines automate the creation of compliance-ready reports, reducing regulatory penalties.

eZintegrations™ is a visual, no-code data pipeline platform built for enterprises like insurance. It enables insurers to automate data integration across core systems, databases, and APIs without long development cycles.

Here’s what sets it apart:

An insurance provider used eZintegrations™ AI Document Understanding to process thousands of claims forms monthly. Instead of weeks of manual review, the platform structured and synced claims data into their CRM and policy system in real-time. This reduced claim settlement times by 40% and improved customer satisfaction scores.

The insurance industry is at a turning point. Data silos, manual workflows, and compliance burdens can no longer keep up with customer and regulator demands. AI Data Integration for Insurance is the key to faster claims, accurate underwriting, and better customer experiences.

With solutions like eZintegrations™, insurers can move beyond patchwork integrations and build intelligent, automated workflows that future-proof their business.

Ready to see how AI data integration can transform your insurance workflows? Book a free demo with eZintegrations™ today.

Recommend Blogs:

How Agentic AI Will Transform Enterprise Systems Beyond 2025

7 Top Data Integration Challenges & Solutions for Enterprises in 2025

AI Workflow Automation: Tools, Best Practices, Guide 2025

AI Data Mapping: Ultimate Guide for Enterprises in 2025

Q1. How does AI data integration differ from traditional data integration in insurance?

Traditional integration connects systems. AI integration adds intelligence, automating data extraction, classification, and real-time decision support.

Q2. What are the main challenges insurers face with data integration?

Key challenges include legacy systems, data silos, compliance demands, and unstructured documents. AI-driven integration addresses all these pain points.

Q3. Is AI data integration secure for sensitive insurance data?

Yes. Platforms like eZintegrations™ provide enterprise-grade security, role-based access, and compliance-ready deployments.

Q4. Can AI integration help with regulatory compliance?

Absolutely. Automated workflows ensure consistent data quality and generate audit-ready compliance reports with minimal manual effort.

Q5. How can insurers get started with AI data integration?

The easiest way is to test-drive platforms like eZintegrations™. Insurers can start small with one integration bridge (free for the first month) and scale across systems.