Insurance companies are sitting behind a goldmine of data, yet they often struggle to unlock its value. In today’s complex, fast-moving market, insurance data management isn’t just about storing data; it’s about processing it efficiently, extracting meaningful insights, and maintaining regulatory compliance.

According to a recent McKinsey report, insurers can cut operational costs by up to 40% with advanced data automation, and even more when paired with intelligent document understanding technologies.

Yet over 70% of insurance firms still rely on manual processes to extract data from policies, claims forms, emails, scanned PDFs, and handwritten submissions. This not only leads to skyrocketing administrative costs but also results in data silos, slow claim cycles, and audit vulnerabilities.

That’s where eZintegrations™ AI Document Understanding becomes a strategic advantage. By automating the extraction, validation, and integration of unstructured insurance data, insurers can optimize operations and achieve remarkable savings both in time and resources.

This blog is for insurance professionals, claims managers, compliance officers, and IT leaders seeking a proven approach to modernize insurance data management using AI.

Insurance data management refers to the collection, processing, validation, and storage of data across insurance operations, including underwriting, policy issuance, claims handling, customer onboarding, and compliance.

In modern insurance workflows, data comes from:

Without a centralized, intelligent way to process this data, insurers face rising operational inefficiencies and compliance gaps.

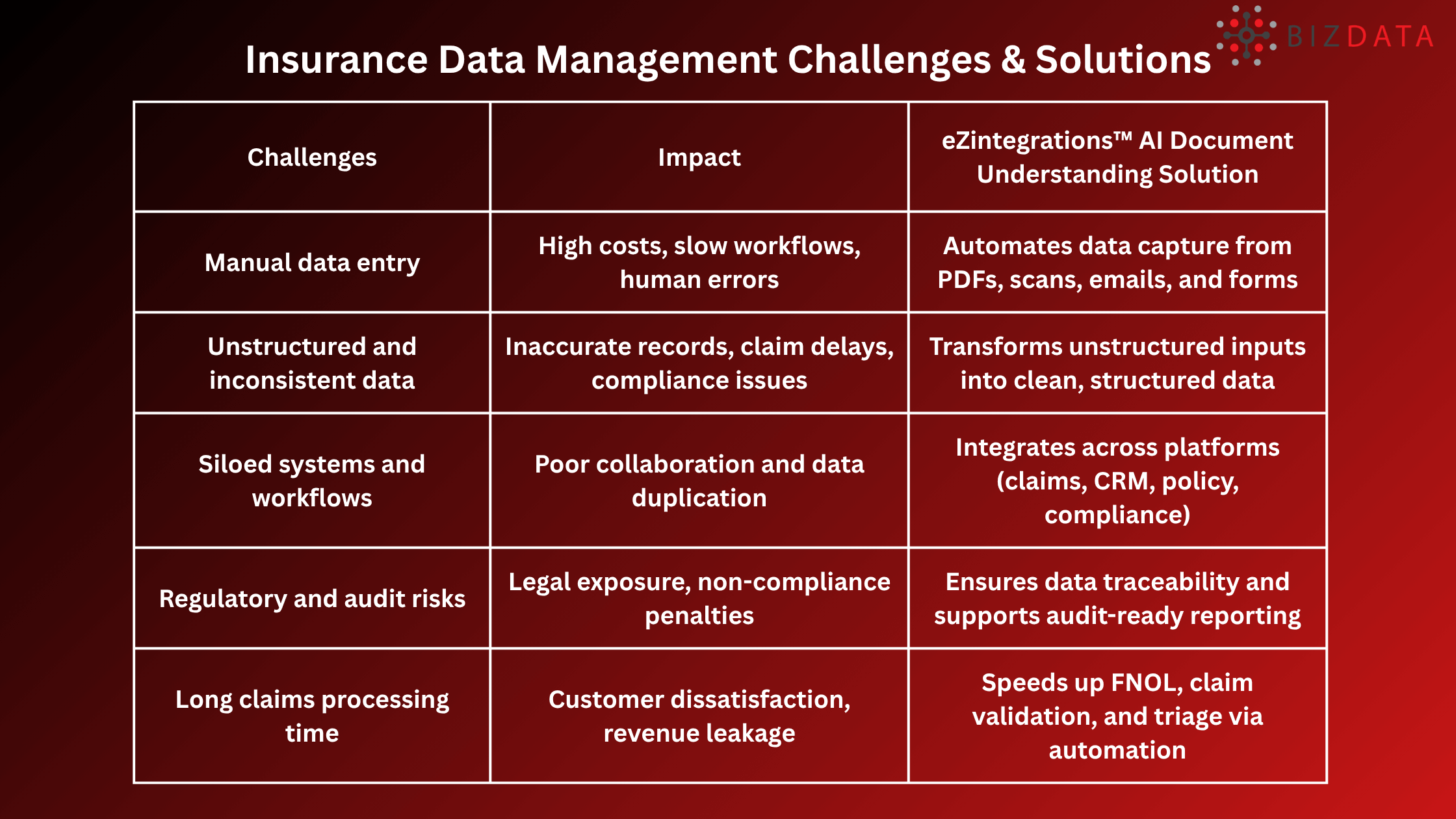

Insurance organizations today are dealing with multiple pain points related to data management that impact productivity, cost, and customer satisfaction.

Most of these issues stem from data being unstructured, disconnected, or manually handled. These challenges create delays, increase risk, and hurt bottom-line performance.

AI Document Understanding is revolutionizing insurance data management by automatically reading, extracting, and structuring data from virtually any document format from PDFs and scanned forms to emails and handwritten notes.

This AI-powered approach transforms how insurers handle document-driven processes and ensures data accuracy, speed, and compliance.

With eZintegrations™ AI Document Understanding, insurers can:

Deploying an AI-based solution like eZintegrations™ doesn’t just automate tasks—it transforms operational performance.

Here are the key outcomes:

AI Document Understanding supports multiple functions across the insurance lifecycle, including:

Each of these can be tailored within eZintegrations™ AI Document Understanding solution to fit the insurer’s specific workflows and systems.

Manual data entry, document errors, and disconnected systems continue to drain time and revenue across insurance operations. With AI Document Understanding, insurers can eliminate these inefficiencies by automatically extracting, validating, and integrating data from claims, policies, and regulatory documents.

It’s not just automation; it’s a strategic leap toward faster claims processing, stronger compliance, and scalable growth in a data-heavy industry.

Designed for scalability, security, and speed, it empowers teams to automate insurance document workflows with unmatched accuracy and control without writing a single line of code.

Manual document handling and fragmented data systems are holding insurers back. By adopting AI Document Understanding through eZintegrations™, insurance firms can modernize claims, cut costs, reduce error rates, and scale efficiently.

This is more than a tech upgrade; it’s a future-proof strategy to stay competitive in a rapidly digitizing industry.

Need help automating your insurance data workflow? Try eZintegrations™ AI Document Understanding for Free or Book a Free Personalized Demo to see how it can optimize your insurance operations.

Recommend Reading:

What is AI Document Understanding in insurance?

It is the use of AI technologies to extract and structure information from unstructured insurance documents such as claims, policies, and compliance forms.

Can eZintegrations™ integrate with our existing claims management system?

Yes. eZintegrations™ supports API-based and file-based integration with most insurance platforms and cloud systems.

Is it secure and compliant with insurance regulations?

Absolutely. eZintegrations™ is HIPAA, SOC2, and GDPR compliant and supports full data encryption.

Which types of insurance documents AI Document Understanding can process?

AI Document Understanding can process various insurance documents, including claims, policies, invoices, quotes, applications, and endorsements.

Do I need developers to set this up?

No. eZintegrations™ is a no-code platform, allowing business teams to configure document workflows without technical expertise.