In the complex world of healthcare revenue cycle management, healthcare claim processing is the cornerstone of financial sustainability. Yet, it remains plagued by inefficiencies, manual data entry, and increasing payer scrutiny. Claim denials have surged in recent years, costing providers billions in missed revenue, delayed payments, and administrative burden.

According to a report from the Medical Group Management Association (MGMA), over 15% of claims are denied on first submission, and nearly 65% of denied claims are never resubmitted, resulting in permanent revenue loss (source). These denials are often caused by missing codes, incomplete forms, or mismatched data between source documents and claim submissions.

In fact, industry data shows that it costs between $25 and $118 to rework a denied claim, depending on the complexity and the provider’s processes (source). AI technologies are making a measurable difference in this area, cutting denial rates by as much as 50% (source).

As payer requirements become more rigid and documentation complexity increases, traditional claim processing methods no longer scale. This is where AI Document Understanding through eZintegrations™ brings significant value.

This blog is tailored for healthcare CFOs, revenue cycle managers, billing specialists, and IT leaders seeking ways to streamline healthcare claim processing, cut denial rates, and modernize their operations.

Healthcare claim processing refers to the lifecycle of preparing, submitting, validating, adjudicating, and reimbursing insurance claims for patient services rendered. It includes:

Manual errors at any stage result in payment delays, higher denial rates, and lost revenue. Even a minor error or missing field can result in delays, rejections, or outright denials. As regulations grow more complex and document volumes increase, automation has become essential.

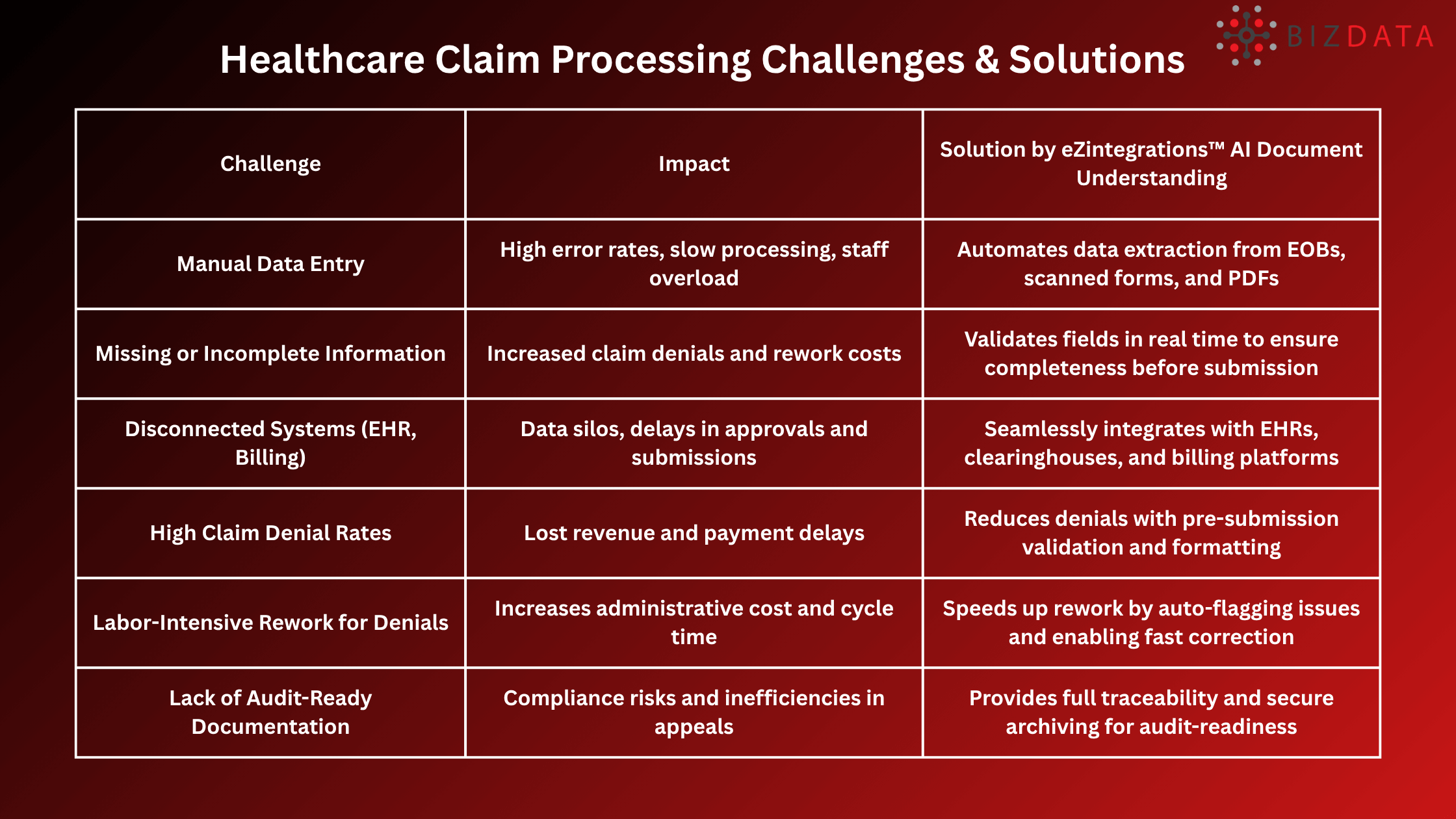

Healthcare organizations face several hurdles in maintaining clean and timely claim submissions. These issues often stem from outdated processes and manual workflows. Addressing these issues is essential for financial stability and operational efficiency.

Denials aren’t just a temporary revenue hiccup they represent a significant operational burden and financial loss:

AI Document Understanding combines Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML) to transform unstructured healthcare documents into structured, usable data. This means AI doesn’t just read documents; it understands them.

In the context of healthcare claim processing, eZintegrations™ AI Document Understanding is especially powerful because healthcare documentation is highly variable. From scanned Explanation of Benefits (EOBs) and handwritten forms to faxes and multi-page PDFs, each claim may come in a different format with different fields and levels of completeness.

It automates the entire lifecycle of claims from intake and validation to formatting and submission, helping eliminate manual errors, reduce denial rates, and accelerate reimbursements.

AI extracts patient demographics, treatment codes, insurance IDs, service dates, and amounts from various documents, whether structured or unstructured, without manual input.

Claims are automatically checked for completeness, consistency, and formatting before submission. The system flags issues such as missing ICD/CPT codes, mismatched provider details, or outdated policy numbers.

eZintegrations™ connects with EHR platforms, clearinghouses, billing systems, and cloud storage so data moves seamlessly from document to claim payout.

By automating the claim intake process, AI reduces human oversight issues like typos, missed checkboxes, and duplicated claims.

All processed documents are archived with full traceability, timestamps, and version control, making audits less burdensome and more transparent.

AI handles thousands of documents simultaneously without fatigue. eZintegrations™ AI Document Understanding empowers healthcare providers to scale their claims operations without increasing headcount.

By digitizing and automating every stage of the claim lifecycle, AI drastically reduces human errors and enhances compliance.

Healthcare providers are under increasing pressure to manage rising volumes of claims with speed and accuracy, all while minimizing administrative costs and denial risks. With eZintegrations™ AI Document Understanding, organizations can unlock tangible operational benefits that go beyond automation enabling real cost savings, accuracy, and scalability.

Reduction in Claim Denial Rate: By intelligently extracting, validating, and formatting claims data from documents before submission, eZintegrations™ AI document understanding helps eliminate common errors that trigger denials. Providers can experience up to 50% drop-in denial rates, leading to more predictable reimbursements and fewer costly appeals.

Faster Rework Cycle for Denied Claims: For the claims that are denied, AI accelerates rework by identifying exactly where data was missed or mismatched and enabling fast corrections. This results in a upto 60% improvement in rework cycle time, helping billing teams resolve issues quickly and restore revenue flow.

Hours Saved Per Month in Manual Data Entry: Manual entry of data from EOBs, scanned forms, and PDFs can save valuable staff time. eZintegrations™AI Document Understanding automates this repetitive task at scale, helping healthcare teams save up to 200+ (example value) hours per month that would otherwise be spent on data entry freeing staff for higher-value activities like denial prevention and patient billing support.

Increase in Clean Claim Submissions on First Attempt: Clean claims accepted on the first submission directly impact cash flow and payer relationships. With AI-driven validation and format standardization, eZintegrations™AI Document Understanding helps providers achieve upto 15–20% increase in clean claims, improving payment cycles and reducing administrative overhead.

AI adoption doesn’t have to be overwhelming. If your organization is experiencing these signs, it’s time to act:

eZintegrations™ AI Document Understanding can help healthcare providers transform these pain points into competitive advantages.

Start Small, Scale Fast: Begin with a pilot workflow, then expand across departments

High denial rates in healthcare claim processing don’t just cause financial strain; they erode operational confidence. With AI Document Understanding from eZintegrations™, providers can reclaim revenue, reduce administrative overhead, and ensure claims are right the first time. This isn’t just digital transformation; it’s strategic optimization.

Try eZintegrations™ AI Document Understanding for Free or Book a Personalized Demo Today

EHR Go-Live Success: Automate Medical Chart Abstraction with AI Today

EMR Integration: AI, Best Practices, Complete Guide 2025

Top Best Healthcare Interoperability Solutions: Guide for 2025

What is healthcare claim denial?

It’s when an insurance payer rejects a submitted claim due to errors, missing information, or non-compliance.

How does AI reduce denial rates?

AI automatically extracts and validates data from documents, ensuring claims are accurate and complete before submission. Especially eZintegrations™ AI Document Understanding, reduces claim denials by accurately extracting and validating data before submission.

Can eZintegrations™ integrate with my EHR or billing system?

Yes. It connects with most healthcare platforms using APIs or pre-built connectors.

Is eZintegrations™ secure and compliant?

Absolutely. It supports HIPAA, HL7, SOC 2, and provides full audit trails for traceability.

How soon can we see the results?

Most providers see a 30–50% drop-in denial rate within 60–90 days of implementation.

Why are healthcare claims often denied, and how can AI help?

Claims are often denied due to errors or missing info, which eZintegrations™ AI Document Understanding detects and corrects automatically.

Benefits of using AI in healthcare claims processing

eZintegrations™ AI Document Understanding boosts efficiency, accuracy, and speeds up approvals in claims processing.

What causes healthcare insurance claim denials and how AI solves it?

Common causes include coding errors and missing documents eZintegrations™ AI Document Understanding automates checks to prevent these issues.